Selling your services and getting paid is a big part of running a successful fitness business. But with all that money changing hands, it’s also important to have a line of sight on your revenues and keep records organized and easy to access, especially for tax season!

To quickly access and export a list of an income year, follow these steps:

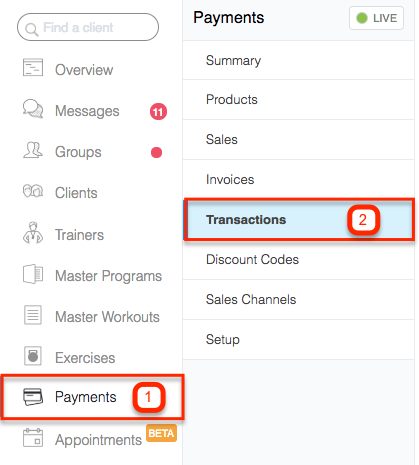

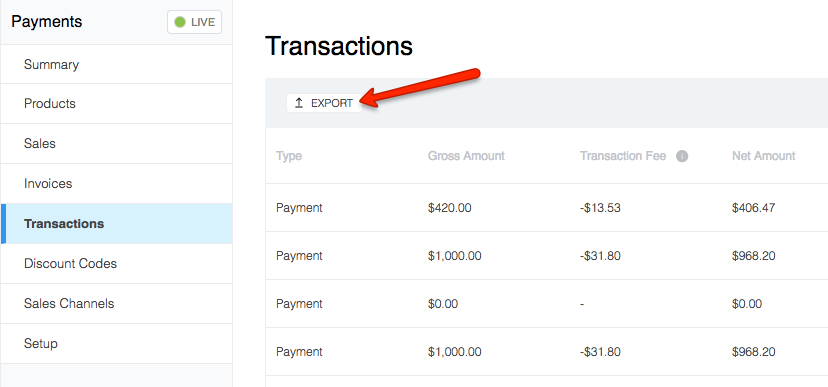

1. Click Payments from the left side menu, then select Transactions

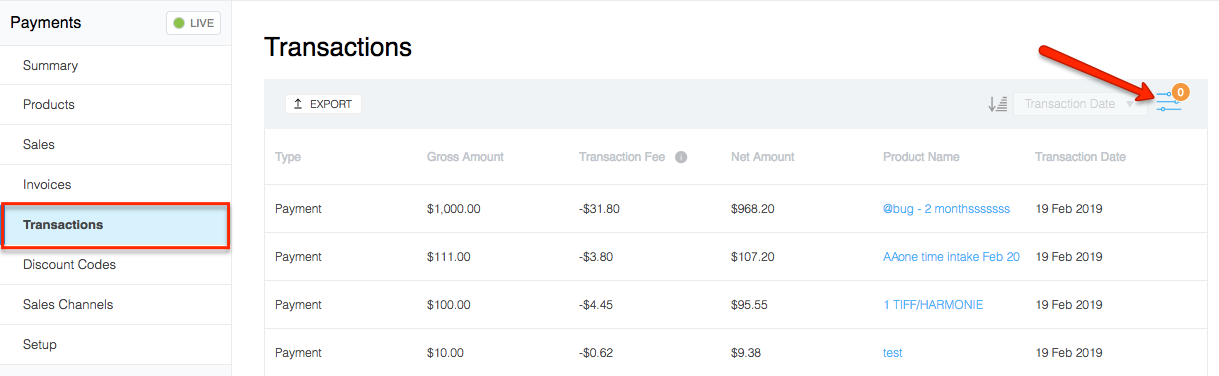

2. On the far right just above the transaction list, click on the filter icon to expand the filter options.

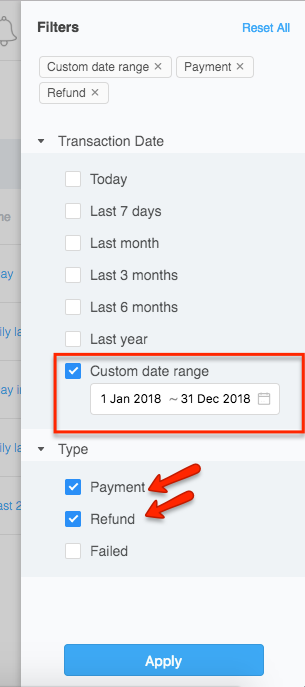

3. To pull up your previous year's income, select the Custom Date Range option under Transaction Date and then Payment and Refund under Type. Click Apply to apply the changes.

^Please note, it is not mandatory to select both Payment and Refund for the same report. You could always do the Payments report first and export the Refunds in a separate one to avoid clutter.

4. Once you've applied the filters, the Transactions grid will refresh and you can click the Export button to export a CVS spreadsheet of your transactions.

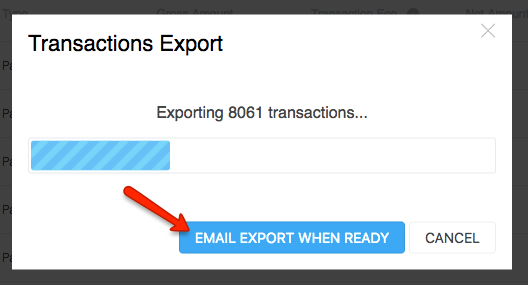

5. If you don't want to wait for the export to download, you can select the EMAIL EXPORT WHEN READY option.

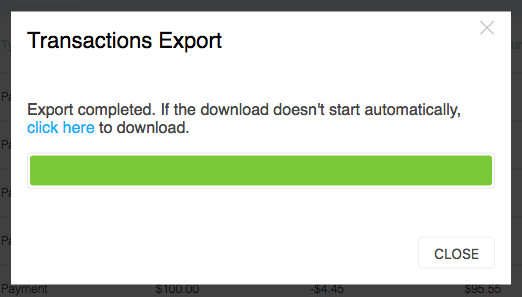

If you don't select the email option, the export will automatically download and give you the option to re-download if you need to.

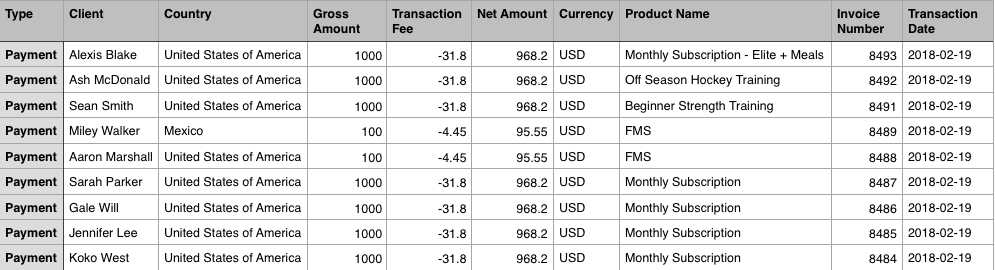

Once you download that export, you will have a CSV spreadsheet that looks like this. Whether you open it in Excel or Numbers, you will have the ability to edit the spreadsheet. For example, you can create a sum for the net amount earned at the bottom of the column, remove columns that you don't want to include, color-code rows so you can easily distinguish between the months, etc.